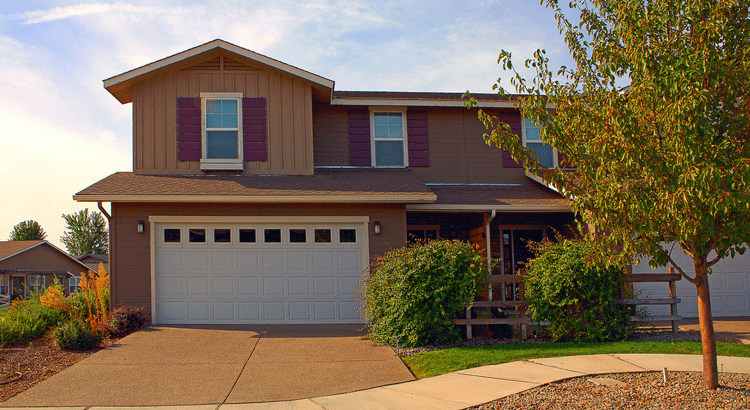

VA Loans: Helping Veterans Achieve Their Homeownership Dreams

The purpose of Veterans Affairs (VA) home loans is to provide a pathway to homeownership for those who have sacrificed so much by serving our nation. As the Veterans Administration says of the program: “The objective of the VA Home Loan Guaranty program is to help eligible Veterans, active-duty personnel, surviving spouses, and members of the Reserves and National Guard purchase, retain, and adapt homes in recognition of their service. . . .” For over 75 years, VA home loans have provided millions of veterans and their families the opportunity to purchase their own homes. 2020 Data on VA Home Loans 1,246,817 home loans are guaranteed by the Veterans Administration The average VA loan amount totals $301,044 178,171 of those using a VA Loan are first-time homebuyers Top Benefits of the VA Home Loan Program As we reflect on their sacrifice and honor our nation’s veterans, it’s important to ensure all veterans know the full extent of benefits VA home loans offer. As Jeff London, Director of the VA Home Loan Program, says: “VA loans offer an extraordinary opportunity for veterans because of lower interest rates, lower monthly payments, no or low-down payments, and no private mortgage insurance.” Those who qualify for a VA home loan are eligible for the following: Borrowers can often purchase a home with no down payment. In 2020, 350,094 individuals using a VA Loan were able to purchase their homes without putting money down. Many other loans with down payments under 20% require Private Mortgage Insurance (PMI). VA Loans do not require PMI, which means veterans can save on their monthly housing costs. Finally, VA-Backed Loans often offer the most competitive terms and interest rates. Bottom Line One way we can honor and thank our veterans this year is to ensure they have the best information about the benefits of VA home loans. Homeownership is the American Dream. Our veterans sacrifice so much in service to our nation and deserve to achieve their homeownership goals. Thank you for your service.

Knowledge Is Power When It Comes to Appraisals and Inspections

Buyers in today’s market often have questions about the importance of getting a home appraisal and an inspection. That’s because high buyer demand and low housing supply are driving intense competition and leading some buyers to consider waiving those contingencies to stand out in the crowded market. But is that the best move? Buying a home is one of the most important transactions in your lifetime, and it’s critical to keep your best interests in mind. Here’s a breakdown of what to expect from the appraisal and the inspection, and why each one can potentially save you a lot of time, money, and headaches down the road. Home Appraisal The home appraisal is a critical step for securing a mortgage on your home. As Home Light explains: “. . . lenders typically require an appraisal to ensure that your loan-to-value ratio falls within their underwriting guidelines. Mortgages are secured loans where the lender uses your home as collateral in case you default on the agreed-upon payments.” Put simply: when you apply for a mortgage, an unbiased appraisal – typically required by your lender – is the best way to verify the value of the home. That appraisal ensures the lender doesn’t loan you more than what the home is worth. When buyers are competing like they are today, bidding wars and market conditions can push prices up. A buyer’s contract price may end up higher than the value of the home – this is known as an appraisal gap. In today’s market, it’s common for the seller to ask the buyer to make up the difference when an appraisal gap occurs. That means, as a buyer, you may need to be prepared to bring extra money to the table if you really want the home. Home Inspection Like the appraisal, the inspection is important because it gives an impartial evaluation of the home. While the appraisal determines the current value of the home, the inspection determines the current condition of the home. As the American Society of Home Inspectors puts it: “Home inspections are the opportunity to discover major defects that were not apparent at a buyer’s showing. . . . Your home inspection is to help you make an informed decision about the house, including its condition.” If there are any concerns during the inspection – an aging roof, a malfunctioning HVAC system, or any other questionable items – you have the option to discuss and negotiate any potential issues with the seller. Your real estate advisor can help you navigate this process and negotiate what, if any, repairs need to be made before the sale is finalized. Keep in mind – home inspections are critical because they can shed light on challenges you may face as the new homeowner. Without an inspection, serious, sometimes costly issues could come as a surprise later on. Bottom Line Both the appraisal and the inspection are important steps in the homebuying process. They protect your best interests as a buyer by providing unbiased information about the home’s value and condition. Let’s connect so you have an expert guiding you throughout the entire process.

Is a 20% Down Payment Really Necessary To Purchase a Home?

There’s a common misconception that, as a homebuyer, you need to come up with 20% of the total sale price for your down payment. In fact, a recent survey by Lending Tree asks what is keeping consumers from purchasing a home. For over half of those surveyed, the ability to afford a down payment is the biggest hurdle. That may be because those individuals assume a 20% down payment is necessary. While putting more money down if you’re able can benefit buyers, putting 20% down is not mandatory. As Freddie Mac puts it: “The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.” If saving that much money sounds overwhelming, you might be ready to give up on the dream of homeownership before you even begin – but you don’t have to. According to the Profile of Home Buyers and Sellers from the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. It may sound surprising, but today’s average down payment is only 12%. That number is even lower for first-time homebuyers, whose average down payment is only 7%. Based on the Home Buyers and Sellers Generational Trends Report from NAR, the graph below shows an even closer look at the down payment percentage various age groups pay: As the graph shows, the only groups who put 20% or more down on average are older homebuyers who likely can use the sale of an existing home to fuel a larger down payment on their next home. What does this mean for you? If you’re a prospective homebuyer, it’s important to know you don’t have to put the full 20% down. And while saving for any down payment amount may feel like a challenge, keep in mind there are programs for qualified buyers that allow them to purchase a home with a down payment as low as 3.5%. There are also options like VA loans and USDA loans with no down payment requirements for qualified applicants. To understand your options, you do need to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like downpaymentresource.com. Be sure to also work with a real estate advisor from the start to learn what you may qualify for in the homebuying process. Bottom Line Don’t let the myth of the 20% down payment halt your homebuying process before it begins. If you want to purchase a home this year, let’s connect to start the conversation and explore your options.

Categories

- All Blogs (607)

- Affordability (12)

- Agent Value (20)

- Baby Boomers (8)

- Buyers (412)

- Buying Myths (117)

- Buying Tips (35)

- Credit (3)

- Demographics (32)

- Distressed Properties (6)

- Down Payment (23)

- Downsize (2)

- Economy (16)

- Equity (8)

- Family (2)

- Featured (8)

- First Time Homebuyers (204)

- For Sale by Owner (1)

- Forecasts (4)

- Foreclosures (26)

- FSBOs (10)

- Gen X (1)

- Gen Z (5)

- Home Improvement (2)

- Home Prices (24)

- Housing Market Updates (231)

- Interest Rates (70)

- Inventory (23)

- Investing (6)

- Kids (2)

- Leasers (6)

- Lenders (4)

- Loans (8)

- Luxury Market (3)

- Market (3)

- Millennials (9)

- Mortgage (18)

- mortgage rates (24)

- Move Up Buyers (84)

- New Construction (13)

- Pricing (95)

- Rent v. Buy (35)

- Self-Employed (1)

- Sellers (273)

- Selling Myths (87)

- Selling Tips (26)

- Senior Market (1)

Recent Posts