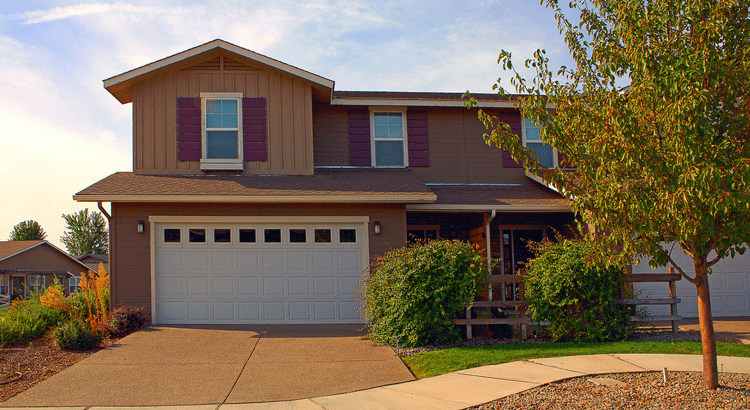

Is It Easier To Find a Home To Buy Now?

One of the biggest hurdles buyers have faced over the past few years has been a lack of homes available for sale. But that’s starting to change. The graph below uses the latest data from Realtor.com to show there are more homes on the market in 2024 than there have been in any of the past several years (2021-2023): Does That Mean Finding a Home Is Easier? The answer is yes, and no. As an article from Realtor.com says: “There were nearly 15% more homes for sale in February than a year earlier . . . That alone could jolt the housing market a bit if more “For Sale” signs continue to appear. However, the nation is still suffering from a housing shortage even with all of that new inventory.” Context is important. On the one hand, inventory is up over the past few years. That means you’ll likely have more options to choose from as you search for your next home. But, at the same time, the graph above also shows there are still significantly fewer homes for sale than there would usually be in a more normal, pre-pandemic market. And that deficit isn’t going to be reversed overnight. What Does This Mean for You? You might find a few more choices now than in recent years, but you shouldn’t expect a ton of options. To help you explore the growing list of choices you have now, team up with a local real estate agent you trust. They can really help you understand the inventory situation where you want to buy. That’s because real estate is local. An experienced agent can share some smart tips they’ve used to help other buyers in your area deal with ongoing low housing supply. Bottom Line If you’re thinking about buying a home, let’s team up. That way, you’ll be up to date on everything that could affect your move, including how many homes are for sale right now.

Single Women Are Embracing Homeownership

In today's housing market, more and more single women are becoming homeowners. According to data from the National Association of Realtors (NAR), 19% of all homebuyers are single women, while only 10% are single men. If you're a single woman trying to buy your first home, this should be encouraging. It means other people are making their dreams a reality – so you can too. Why Homeownership Matters to So Many Women For many single women, buying a home isn't just about having a place to live—it's also a smart way to invest for the future. Homes usually increase in value over time, so they’re a great way to build equity and overall net worth. Ksenia Potapov, Economist at First American, says: “. . . single women are increasingly pursuing homeownership and reaping its wealth creation benefits.” The financial security and independence homeownership provides can be life-changing. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer. The same report from NAR shares the top reasons single women are buying a home right now, and the reality is, they’re not all financial (see chart below): If any of these reasons resonate with you, maybe it’s time for you to buy too. Work with a Trusted Real Estate Agent If you’re a single woman looking to buy a home, it is possible, even in today’s housing market. You’ll just want to be sure you have a great real estate agent by your side. Talk about what your goals are and why homeownership is so important to you. That way your agent can keep what’s critical for you up front as they guide you through the buying process. They’ll help you find the right home for your needs and advocate for you during negotiations. Together, you can make your dream of homeownership a reality. Bottom Line Homeownership is life-changing no matter who you are. Let's connect today to talk about your goals in the housing market.

What Every Homebuyer Should Know About Closing Costs

Before making the decision to buy a home, it's important to plan for all the costs you’ll be responsible for. While you're busy saving for the down payment, don't forget you’ll want to prep for closing costs too. Here’s some helpful information on what those costs are and how much you should budget for them. What Are Closing Costs? A recent article from Bankrate explains: “Closing costs are the fees and expenses you must pay before becoming the legal owner of a house, condo or townhome . . . Closing costs vary depending on the purchase price of the home and how it’s being financed . . .” Simply put, your closing costs are the additional fees and payments you have to make at closing. According to Freddie Mac, while they can vary by location and situation, closing costs typically include: Government recording costs Appraisal fees Credit report fees Lender origination fees Title services Tax service fees Survey fees Attorney fees Underwriting Fees How Much Are Closing Costs? According to the same Freddie Mac article mentioned above, they’re typically between 2% and 5% of the total purchase price of your home. With that in mind, here’s how you can get an idea of what you’ll need to budget. Let’s say you find a home you want to purchase at today’s median price of $384,500. Based on the 2-5% Freddie Mac estimate, your closing fees could be between roughly $7,690 and $19,225. But keep in mind, if you’re in the market for a home above or below this price range, your closing costs will be higher or lower. Make Sure You’re Prepared To Close Freddie Mac provides great advice for homebuyers, saying: “As you start your homebuying journey, take the time to get a sense of all costs involved – from your down payment to closing costs.” The best way to do that is by partnering with a team of trusted real estate professionals. That gives you a group of experts to help you understand how much you’ll need to save and what you’ll want to be prepped for. It also means you have go-to resources for any questions that pop up along the way. Bottom Line Planning for the fees and payments you'll need to cover when you're closing on your home is important. Partnering with a local real estate professional can give you the guidance and confidence you need throughout the process.

Categories

- All Blogs (605)

- Affordability (12)

- Agent Value (18)

- Baby Boomers (8)

- Buyers (411)

- Buying Myths (117)

- Buying Tips (34)

- Credit (3)

- Demographics (32)

- Distressed Properties (6)

- Down Payment (23)

- Downsize (2)

- Economy (15)

- Equity (8)

- Family (2)

- Featured (8)

- First Time Homebuyers (204)

- For Sale by Owner (1)

- Forecasts (4)

- Foreclosures (26)

- FSBOs (10)

- Gen X (1)

- Gen Z (5)

- Home Improvement (2)

- Home Prices (24)

- Housing Market Updates (231)

- Interest Rates (70)

- Inventory (23)

- Investing (6)

- Kids (2)

- Leasers (6)

- Lenders (4)

- Loans (8)

- Luxury Market (3)

- Market (3)

- Millennials (9)

- Mortgage (18)

- mortgage rates (23)

- Move Up Buyers (84)

- New Construction (13)

- Pricing (95)

- Rent v. Buy (35)

- Self-Employed (1)

- Sellers (273)

- Selling Myths (87)

- Selling Tips (26)

- Senior Market (1)

Recent Posts